What I Learned About Paying for College — Before It Broke My Budget

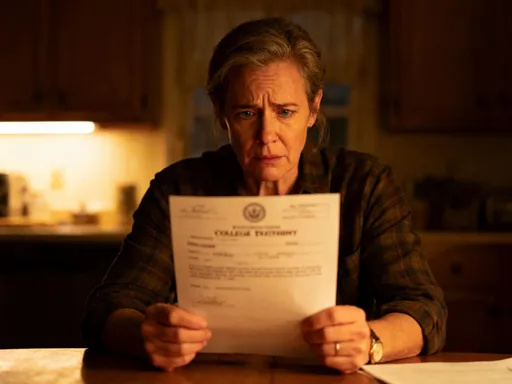

Raising kids is expensive, but nothing hits quite like the sticker shock of college costs. I remember sitting at my kitchen table, staring at tuition estimates, wondering how we’d ever afford it. That moment pushed me to dig deeper into real strategies — not hype, not promises, but practical moves that actually work. This is the cost analysis I wish I’d done years earlier, shared straight up, no fluff. What started as a personal crisis became a journey through budgets, emotions, and long-term planning. The truth is, college doesn’t have to break the bank — but only if you face the numbers early, make informed choices, and protect your financial future while investing in your child’s.

The Hidden Price Tag of Education: What No One Tells You

When most parents think about college costs, tuition is the first number that comes to mind. It's the figure highlighted in brochures and quoted on university websites. But tuition is only part of the story — often not even the largest part when all expenses are tallied. The full cost of a college education includes room and board, textbooks, transportation, technology, health insurance, personal expenses, and even laundry. These additional costs can add thousands of dollars per year to a family’s financial burden, and they are frequently overlooked in early planning stages. A realistic budget must account for every category, not just the headline tuition rate.

Consider this: the average annual cost of room and board at a four-year public university exceeds $12,000, and at private institutions, it can surpass $15,000. Textbooks and supplies alone average over $1,200 per year, and those costs rise steadily. A laptop or tablet may seem like a one-time expense, but technology needs evolve, and replacements or upgrades are often necessary. Transportation — whether driving to campus, flying home for breaks, or using public transit — adds another layer of recurring cost. Even small weekly expenses, like coffee, snacks, or printing assignments, accumulate over semesters and years. When added together, these non-tuition items can equal or even surpass the price of tuition in some cases, especially at lower-cost public schools.

One family I spoke with assumed their child’s total college cost would be about $25,000 per year based on published tuition. After tracking actual spending during the first year, they realized the true cost was closer to $38,000 — a difference of $13,000 they hadn’t planned for. This gap came from underestimating housing, meal plans, books, and incidental spending. The lesson? Relying on advertised tuition figures without a comprehensive cost analysis sets families up for financial strain. A clear, itemized budget that includes every possible expense is the foundation of smart college planning. It allows for accurate saving goals, informed school comparisons, and realistic conversations with students about what’s affordable.

Moreover, these costs are not static. Inflation affects college expenses just like any other sector, with education costs historically rising faster than general inflation. Over four years, even a 3% annual increase can add thousands to the total bill. Families who fail to account for this upward trend may find themselves underfunded by graduation. Planning should include built-in adjustments for cost increases, treating college funding like a long-term financial commitment rather than a one-time payment. By expanding the definition of “college cost” beyond tuition, families gain a more accurate picture of what they’re truly facing — and can make decisions that align with their financial reality.

Why Emotions Sabotage Smart Planning (And How to Stop It)

One of the most underestimated challenges in college planning isn’t financial — it’s emotional. Parents want the best for their children, and that desire often translates into a willingness to spend beyond their means. The fear of “holding a child back” or “not giving them every opportunity” can override sound financial judgment. Many parents feel pressure to send their child to a prestigious or faraway school, even if it means taking on significant debt or draining retirement savings. These decisions are rarely made with spreadsheets; they’re driven by love, pride, and sometimes social comparison. But when emotions dominate financial decisions, the long-term consequences can be severe.

I’ve seen families choose private universities over in-state options simply because the name sounded more impressive, despite minimal differences in academic quality or job placement outcomes. Others have committed to full tuition payments without discussing financial limits with their children, only to face stress and resentment later when budgets tighten. In some cases, parents have taken on second mortgages or withdrawn from retirement accounts, believing they’re making a noble sacrifice. But these actions often come at a high cost — delayed retirement, increased stress, and reduced financial security in later years. The irony is that children rarely ask for these sacrifices; they just want to succeed. Yet without open conversations, parents may assume more responsibility than necessary or appropriate.

Social pressure also plays a role. When friends talk about sending their kids to elite schools or paying for study abroad programs, it’s easy to feel inadequate if your plan looks different. But every family’s financial situation is unique. Comparing your journey to others’ can lead to overspending and poor choices. One parent admitted she felt embarrassed admitting her child would start at a community college, even though it saved her family over $40,000 in the first two years. Her hesitation wasn’t about the quality of education — it was about perception. Overcoming these emotional barriers requires self-awareness and courage. It means defining success on your own terms, not someone else’s.

The solution isn’t to eliminate emotion — that’s neither possible nor desirable. Instead, it’s about creating space between feeling and action. Before making any major decision, pause and ask: Is this based on data or desire? Can we afford this without compromising long-term goals? Have we discussed trade-offs with our child? Writing down financial priorities and limits in advance helps anchor decisions in reality. Involving teens in the conversation also reduces the emotional weight on parents alone. When children understand the cost of options, they often become partners in finding affordable paths. Emotional intelligence, paired with financial clarity, leads to choices that support both dreams and sustainability.

The Real Cost of Waiting: Time Is Your Greatest Ally

One of the most powerful tools in college planning isn’t a special account or tax break — it’s time. The earlier families begin saving, the more they benefit from compound growth, even with modest contributions. Yet many parents delay saving, waiting for a “better” financial moment that may never come. They tell themselves they’ll start when the car is paid off, when the house is refinanced, or when income increases. But each year of delay reduces the potential for growth and increases the pressure to catch up later. Procrastination has a real financial cost — one that’s often overlooked in the stress of daily life.

Consider two families with identical goals: saving $100,000 for college. Family A starts when their child is 5, contributing $300 per month into a 529 plan with an average annual return of 6%. By the time the child turns 18, they’ve contributed $46,800 and watched it grow to approximately $100,000. Family B waits until the child is 10 to begin, using the same monthly contribution and return rate. By age 18, they’ve contributed $28,800 but only accumulated about $40,000 — less than half the target. To reach $100,000, they’d need to nearly triple their monthly contribution. The five-year delay cost them not just time, but financial flexibility and peace of mind.

This example illustrates the power of compounding — money earned on previous earnings — which only works when given enough time to grow. Even small, consistent contributions made early can have a dramatic impact. A family that invests $100 per month starting at birth could accumulate over $30,000 by age 18, assuming a 6% return. Waiting until age 10 reduces that total to around $12,000. The difference isn’t due to smarter investing — it’s due to starting sooner. Time allows for lower monthly burdens and reduces the need for loans or last-minute sacrifices.

Of course, not every family can start saving in infancy. Life happens — job changes, medical bills, housing costs. But the principle remains: start as early as possible, even if the amount seems insignificant. $50 a month is better than $0. Automatic transfers make saving easier and less visible, reducing the temptation to skip contributions. The goal isn’t perfection — it’s consistency. Every dollar saved early reduces the amount that must be borrowed or earned later. Time won’t wait, but financial progress can begin today, no matter where you are in the journey. The real cost of waiting isn’t just lost growth — it’s increased stress, limited options, and a heavier burden on everyone involved.

Where to Save: Accounts That Actually Work for Education

Not all savings vehicles are equally effective for college funding. Some offer tax advantages, others provide flexibility, and a few strike a balance between the two. Choosing the right account depends on your goals, timeline, and financial situation. The most well-known option is the 529 plan, which allows tax-free growth and withdrawals when funds are used for qualified education expenses. These plans are widely available, easy to open, and often managed by state governments with low fees. Contributions don’t reduce federal taxable income, but many states offer deductions or credits for residents who contribute. The major benefit is long-term tax-free growth, making 529s ideal for families focused solely on education funding.

However, 529 plans come with limitations. Funds must be used for eligible expenses — tuition, fees, room and board, books, and certain technology costs. Using money for non-qualified purposes triggers taxes and a 10% penalty on earnings. While recent legislation allows up to $10,000 in lifetime distributions for K–12 tuition and another $35,000 for student loan repayment, the rules remain restrictive. Additionally, 529 assets owned by parents are assessed lightly in financial aid formulas, but those owned by grandparents can reduce aid eligibility when withdrawn. Families should coordinate timing to minimize this impact, such as delaying withdrawals until after financial aid applications are complete.

Another option is the Coverdell Education Savings Account (ESA), which also offers tax-free growth and withdrawals for education. Unlike 529s, Coverdell ESAs can be used for K–12 and college expenses, including tutoring and special needs services. However, annual contribution limits are much lower — just $2,000 — and income restrictions apply. High-earning families may not qualify to contribute at all. While flexible, the low cap makes Coverdell accounts better suited as supplements rather than primary savings tools.

Custodial accounts, such as UGMA or UTMA, offer maximum flexibility — funds can be used for any purpose that benefits the child — but lack tax advantages for education. Earnings are taxed each year, and once the child reaches adulthood, they gain full control of the account. These accounts also count heavily against financial aid, potentially reducing eligibility. General investment or savings accounts provide full control and no usage restrictions, but without the tax benefits of 529s or Coverdells. They may be useful for families who want to keep options open or who are uncertain about future education paths.

The best approach often involves a mix of tools. A 529 plan may serve as the core education fund, while a general savings account covers incidentals. Some families use 529s for one child and custodial accounts for another, depending on goals. The key is aligning the account type with your priorities: tax efficiency, flexibility, control, and impact on financial aid. There’s no one-size-fits-all solution, but informed choices lead to better outcomes. Research, consultation with a financial advisor, and periodic reviews ensure your strategy stays on track.

Cutting Costs Without Sacrificing Quality

Many families assume that higher cost equals better education, but that’s not always true. Research consistently shows that students who start at community colleges and transfer to four-year institutions often graduate with similar outcomes — in terms of GPA, job placement, and graduate school acceptance — as those who attend four-year schools from the start. Yet they do so at a fraction of the cost. A two-year associate degree at a public community college averages under $4,000 per year, compared to over $10,000 at a public four-year school and over $38,000 at a private one. By completing general education requirements at a community college, students can save $20,000 or more without compromising academic quality.

In-state public universities offer another high-value option. Tuition for residents is significantly lower than out-of-state rates, and many state schools have strong programs in engineering, business, and the sciences. Some even offer merit-based scholarships that further reduce costs. Students who choose in-state schools often build local networks that support internships and job opportunities. Living at home, even part-time, can also reduce housing and meal plan expenses. These choices aren’t about settling — they’re about strategy. Value isn’t measured by prestige alone, but by return on investment: what you gain relative to what you pay.

Dual enrollment programs allow high school students to take college courses for credit, often at no or low cost. These courses count toward both high school and college graduation requirements, shortening the time to degree completion. A student who earns 20 college credits in high school could save a full semester’s worth of tuition and graduate earlier. Early college programs, offered through partnerships between high schools and local colleges, provide structured pathways to degree completion. These options are especially beneficial for motivated students in areas with strong community college systems.

Another smart strategy is encouraging students to work part-time during college. Earnings can cover personal expenses, reduce borrowing, and build work experience. Paid internships in the student’s field of study offer even greater value, combining income with career development. Some families establish a shared responsibility model — parents cover tuition and housing, while students cover books, transportation, and entertainment through work or savings. This approach fosters financial responsibility and reduces the burden on parents. Cutting costs isn’t about deprivation — it’s about making intentional, informed choices that support long-term success without unnecessary debt.

How to Talk Money With Your Kids (Without Ruining Their Dreams)

One of the most important — and most difficult — conversations families face is discussing college costs with their children. Many parents avoid the topic, fearing it will limit their child’s aspirations or cause stress. But silence creates uncertainty, and uncertainty leads to unrealistic expectations. When teens don’t understand the financial realities of college, they may apply to schools that are out of reach, assume loans will cover everything, or feel guilty about accepting help. Open, age-appropriate conversations build trust, promote responsibility, and align expectations.

Start early — not with numbers, but with values. Discuss the importance of education, the variety of paths to success, and the role of planning. As children grow, introduce basic budgeting concepts. In high school, involve them in comparing college costs. Show them real data: tuition, room and board, estimated loans, and potential starting salaries in different fields. Use online net price calculators to estimate what each school would actually cost your family. When students see side-by-side comparisons — for example, a $250,000 private school versus a $80,000 in-state option with scholarships — they often engage in thoughtful decision-making.

Frame the conversation as a partnership, not a limitation. Instead of saying, “We can’t afford that school,” try, “Let’s find the best option that fits our budget.” Encourage teens to research scholarships, work-study programs, and cost-saving strategies like dual enrollment. Some families set a maximum loan limit — such as no more than one year’s expected starting salary — and involve the student in staying under it. When young adults understand the long-term impact of debt, they often make more conservative choices.

These discussions don’t dampen dreams — they ground them. A student who knows the financial landscape can pursue ambitious goals with eyes open. They may still aim for competitive schools, but they’ll also look for ways to make it affordable. Transparency reduces resentment and builds financial literacy that lasts a lifetime. Money talks aren’t one-time events; they’re ongoing dialogues that evolve as plans change. By starting early and keeping the conversation respectful, families turn financial planning into a shared journey rather than a source of conflict.

Building a Safety Net: Preparing for the Unexpected

Even the most careful plans can be disrupted by life. A parent might lose a job, a medical issue could arise, or a scholarship might not be renewed. Colleges change policies, and economic conditions shift. That’s why every college funding strategy should include a safety net — a set of backup options designed to maintain progress without derailing the entire plan. Resilience isn’t about avoiding problems; it’s about preparing for them.

An emergency fund is the first line of defense. Ideally, families should have three to six months of living expenses set aside in a liquid account. This fund isn’t meant for routine college costs — it’s for true emergencies that could otherwise force a student to drop out. Knowing there’s a financial cushion reduces stress and allows for calmer decision-making when crises occur. Some families also consider income protection, such as disability insurance or life insurance, to safeguard against loss of income due to illness or death.

Flexible academic paths are another key component. Taking a gap semester or year to work and save is a legitimate strategy, not a failure. Many students return more focused and financially prepared. Switching to part-time enrollment while working can extend the timeline but reduce borrowing. Community colleges remain a reliable option for continuing education at lower cost. Some students complete degrees through online programs while living at home, balancing work and study.

Understanding financial aid appeal processes is also important. If a family’s financial situation changes — due to job loss, divorce, or medical bills — they can request a reassessment of aid eligibility. Providing documentation to the financial aid office may result in additional grants or reduced expected contribution. Many families don’t know this option exists, so awareness is critical. Additionally, having a backup financing plan — such as a low-interest private loan option or a home equity line of credit (used cautiously) — can provide temporary relief when needed.

The goal isn’t to predict every problem, but to build adaptability into the plan. When families acknowledge that setbacks may happen, they reduce the stigma around adjusting course. Education is a marathon, not a sprint, and there are many ways to cross the finish line. A safety net ensures that a single setback doesn’t become a permanent obstacle. By planning for the unexpected, families protect both their financial stability and their child’s future.